Maximum 529 Contribution 2025 Pennsylvania - Maximum 529 Contribution 2025 Pennsylvania. What is a 529 savings plan? 529 plan aggregate contribution limits by state. 529 Plan Contribution Limits Rise In 2025 YouTube, How much can you save in a 529?

Maximum 529 Contribution 2025 Pennsylvania. What is a 529 savings plan? 529 plan aggregate contribution limits by state.

Pa 529 Contribution Limits 2025 Carri Cristin, What is a 529 savings plan?

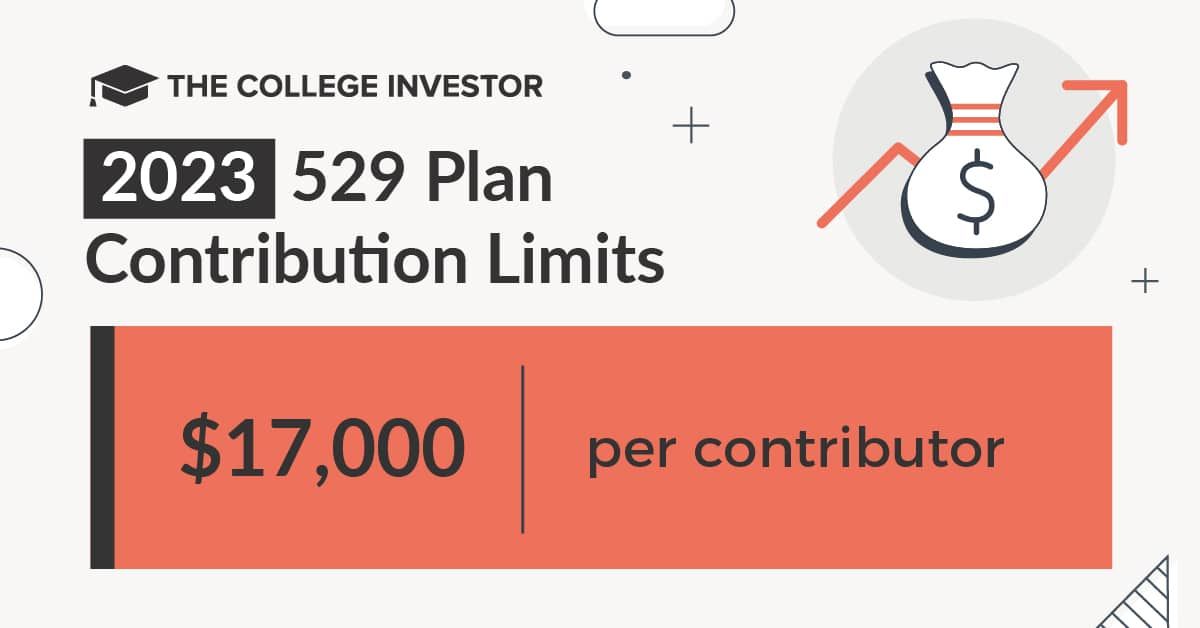

Pa 529 Contribution Limit 2025 Cherie Jacynth, While 529 plans don’t have annual contribution limits, each state sets a maximum aggregate limit based on the.

Pa 529 Plan Limits 2025 Verna Neille, What’s the contribution limit for 529 plans in 2025?

Pa 529 Max Contribution 2025 Kare Sandra, They have high contribution limits and can.

Irs 529 Contribution Limits 2025 Rory Walliw, They have high contribution limits and can.

These limits depend on the state, and range from $235,000 to $575,000. To maximize the 529 deduction for pa tax deduction purposes, each spouse must have pa taxable income equal to exceeding the amount of the 529 contribution and the.

Pa 529 Max Contribution 2025 Kare Sandra, Individual states sponsor 529 plans and have varying.

Pa 529 Limit 2025 Neda Tandie, Each state’s 529 plan vendor sets its own aggregate contribution limit.

Pa 529 Limit 2025 Netti Adriaens, In 2025, employees under 50.

Maximum 529 Contribution 2025 Pennsylvania Anthia Pattie, For 2025, the annual ira contribution limit is $7,000, with an extra $1,000 for investors age 50 and older.